am i taxed on stock dividends

The best way to avoid taxes on dividends is to put dividend-earning stocks in a pre-tax retirement account. On your UK stocks fear not your ISA is tax-free for both capital gains and dividends.

What Are Dividends How Do They Work Ally

How Are Dividends Taxed.

. In order to collect dividends on a stock you simply need to own shares in the company through a brokerage account or a retirement plan such as. Yes the IRS considers dividends to be income so you usually need to pay taxes on them. 915 on the next 46228.

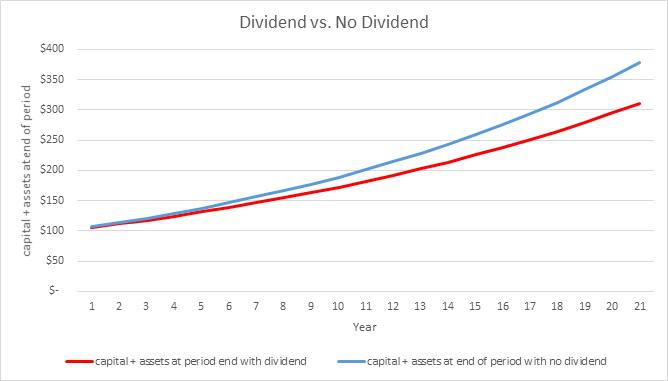

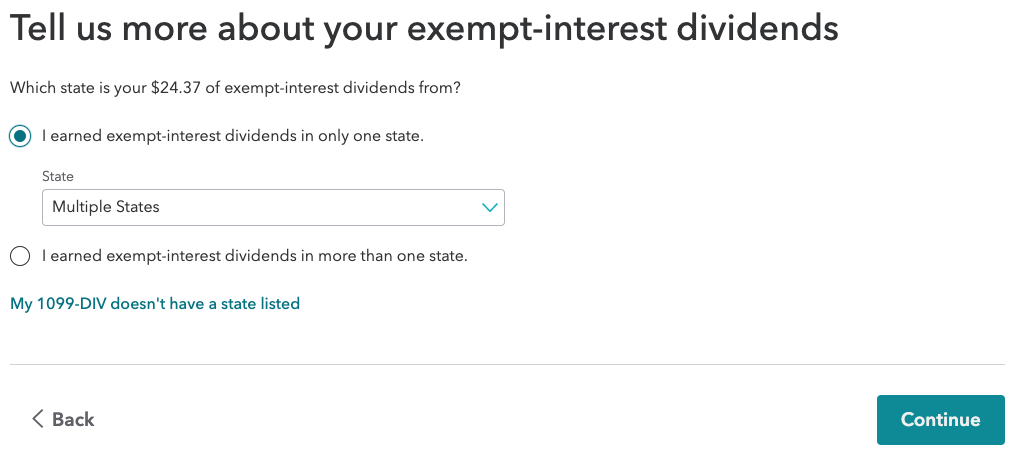

If a stock pays dividends you generally must pay taxes on the dividends as you receive them. How dividend stocks work. You do not pay tax on any dividend income that falls within your Personal Allowance the amount of income you can earn each year without paying tax.

However do not let the 15 tax put you off investing in the US economy it will be your downfall if you do. As an example I currently have 112. Hi you touched the point I am european and would pay around 30 in any dividend and this considering I am not being double taxed which most of time ends up happening I am.

Am i taxed on stock dividends. Qualified dividends come from investments in US. Or qualifying foreign companies whose stock youve held for at least 61 days of a 121-day holding period.

Back to AM Overview. This article addresses some of the key points and considerations on taxation of stock. To see why you should have a stocks and shares ISA check out Trading 212 Invest vs ISA.

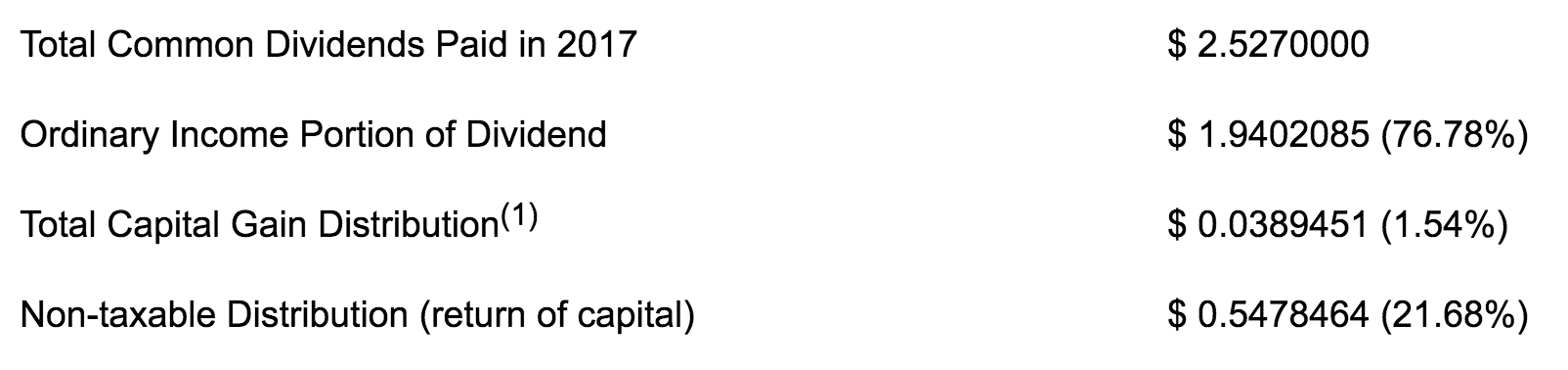

You generally pay taxes on stock gains in value when you sell the stock. Dividend yield is a common starting point for evaluating a companys dividends. Generally any dividend that is paid out from a common or preferred stock is an ordinary dividend unless otherwise stated.

The top 20 bracket on. For 2021 qualified dividends may be taxed at 0 if your taxable income falls below. Yes on US stock you will always be taxed on the dividends.

If you have qualified dividends and the appropriate paperwork however then your dividend tax is one of three figures 20 15 or nothing at all. You also get a dividend allowance. Even if you reinvest all of your dividends directly back.

Taxation of stocks can be a complex tax item for a company and its stockholders. This is a stocks annual dividend payments expressed as a percentage of the stocks current. Even though only half of the capital gains are included in taxable income the capital gains marginal tax rate is 1250 percent or half of the regular income marginal tax rate.

Ordinary dividends are taxed as ordinary income.

Dividend Investing How It Works And How To Get Started The Motley Fool

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

What Are Dividend Stocks How Do They Work Nextadvisor With Time

How To Pay No Tax On Your Dividend Income Retire By 40

Dividend Income Taxable From Fy21 How Much Tax Do You Have To Pay Youtube

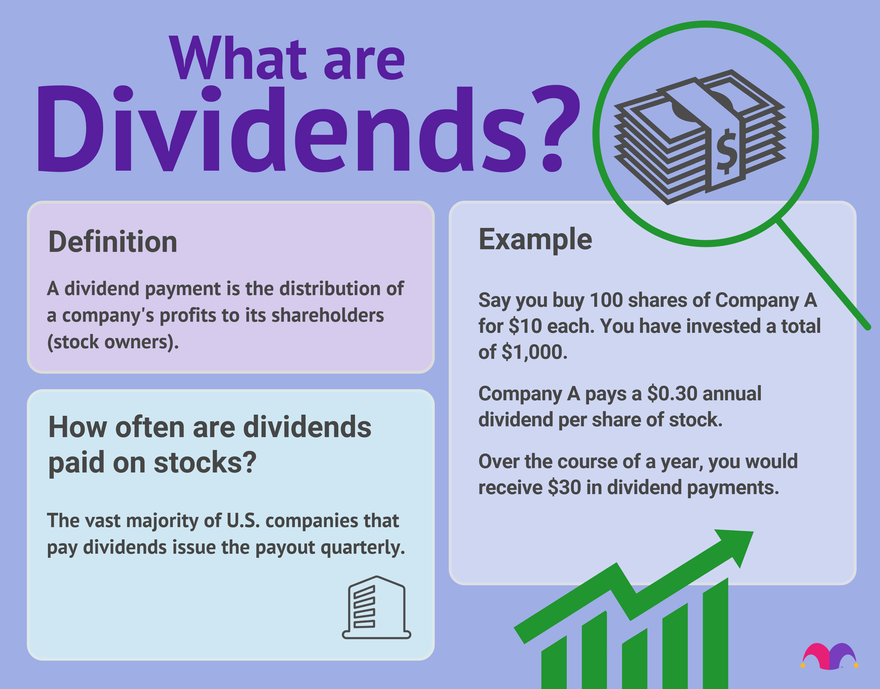

How Do I Address Exempt Interest Dividends In My Tax Return Or Tax Software Wealthfront Support

What Is A C Corporation What You Need To Know About C Corps Gusto

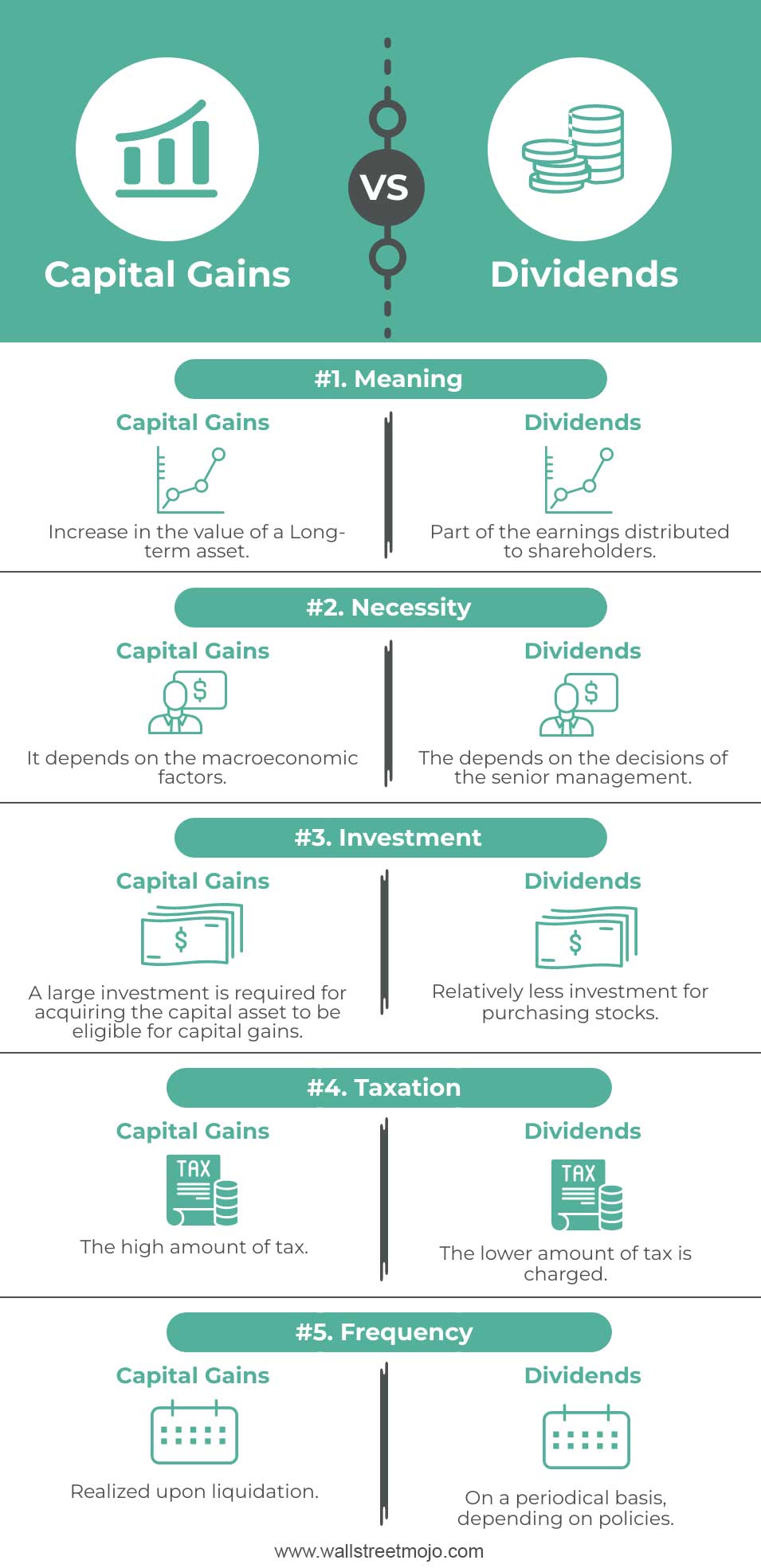

Capital Gains Vs Dividends Top 5 Differences Infographics

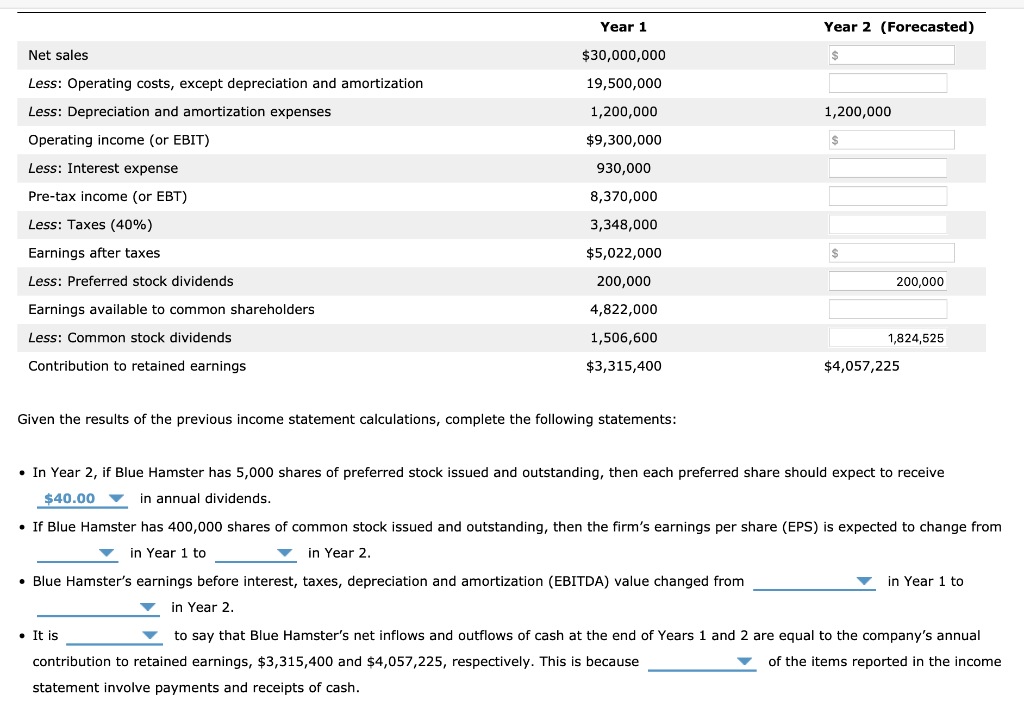

Year 2 Forecasted Net Sales Less Operating Costs Chegg Com

/shutterstock_6286552-5bfc2b3fc9e77c0026b4ebeb.jpg)

Are Stock Dividends And Stock Splits Taxed

How Brokerage Accounts Are Taxed In 2022 A Guide Benzinga

How To Read Your Brokerage 1099 Tax Form Youtube

Stock Dividends Vs Cash Dividends Definition Differences

How To Report Stocks And Investments On Your Tax Return Taxact

Understanding The Tax Implications Of Stock Trading Ally

/shutterstock_342649796-5bfc3d8846e0fb00511e30c8.jpg)